How Medicare Graham can Save You Time, Stress, and Money.

Wiki Article

An Unbiased View of Medicare Graham

Table of ContentsThe 6-Second Trick For Medicare GrahamIndicators on Medicare Graham You Need To KnowThe 10-Second Trick For Medicare GrahamAll About Medicare GrahamIndicators on Medicare Graham You Need To Know

Prior to we speak regarding what to ask, let's chat about who to ask. For many, their Medicare trip begins straight with , the official website run by The Centers for Medicare and Medicaid Providers.

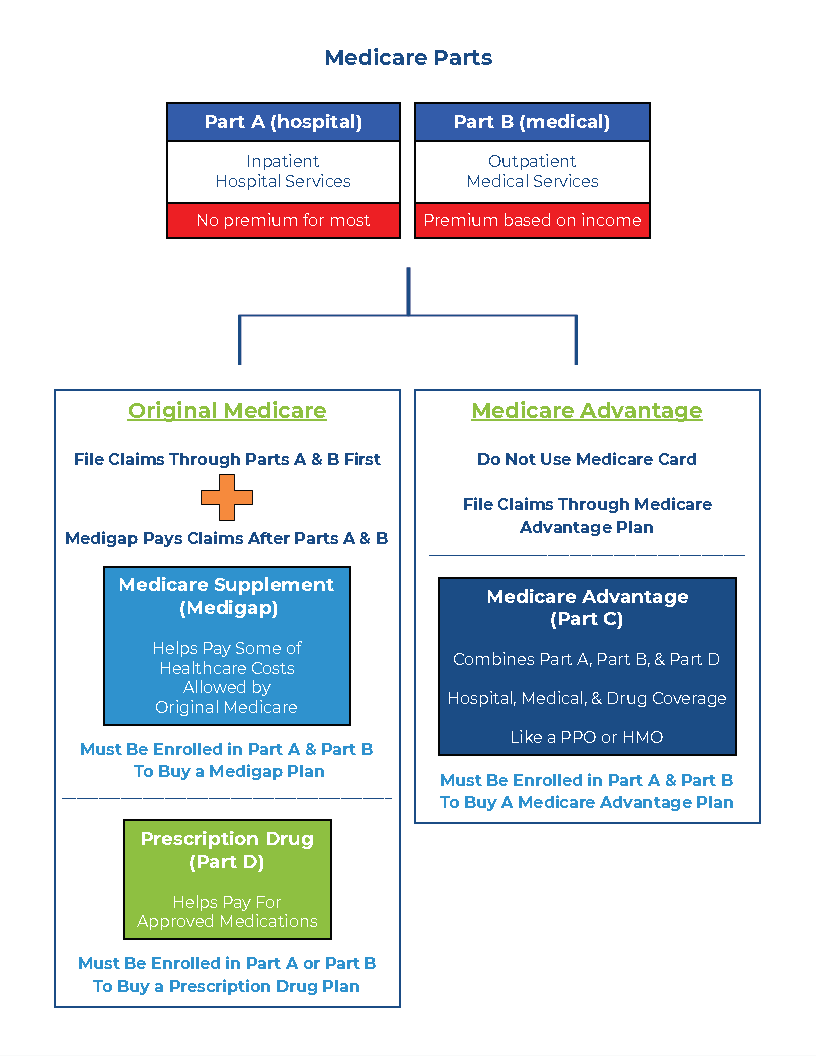

It covers Part A (hospital insurance coverage) and Component B (medical insurance). These strategies work as an alternative to Original Medicare while using more advantages.

Medicare Component D plans aid cover the expense of the prescription drugs you take at home, like your daily medicines. You can sign up in a different Part D plan to add medicine protection to Original Medicare, a Medicare Price plan or a few other kinds of plans. For several, this is usually the very first inquiry taken into consideration when searching for a Medicare plan.

The 3-Minute Rule for Medicare Graham

To obtain the most economical health and wellness care, you'll want all the services you use to be covered by your Medicare plan. Your plan pays whatever.and seeing a supplier that accepts Medicare. But what concerning taking a trip abroad? Many Medicare Benefit strategies provide worldwide insurance coverage, as well as coverage while you're traveling locally. If you intend on traveling, make sure to ask your Medicare consultant regarding what is and isn't covered. Perhaps you have actually been with your existing doctor for some time, and you desire to keep seeing them.

Some Known Facts About Medicare Graham.

Lots of people who make the button to Medicare continue seeing their regular medical professional, but also for some, it's not that easy. If you're dealing with a Medicare expert, you can inquire if your doctor will certainly be in network with your brand-new plan. However if you're taking a look at strategies individually, you may need to click imp source some links and make some phone calls.For Medicare Advantage plans and Cost plans, you can call the insurer to ensure the medical professionals you wish to see are covered by the plan you want. You can additionally check the strategy's web site to see if they have an on the internet search device to discover a covered doctor or center.

Which Medicare plan should you go with? Beginning with a listing of considerations, make sure you're asking the best questions and begin focusing on what type of plan will certainly best serve you and your requirements.

The Main Principles Of Medicare Graham

Are you regarding to turn 65 and become freshly qualified for Medicare? The least costly plan is not necessarily the ideal alternative, and neither is the most costly plan.Also if you are 65 and still working, it's a good concept to examine your options. People obtaining Social Security advantages when turning 65 will be immediately enrolled in Medicare Parts A and B. Based upon your employment scenario and healthcare alternatives, you may need to think about enrolling in Medicare.

After that, take into consideration the different kinds of Medicare prepares offered. Initial Medicare has two parts: Part A covers a hospital stay and Part B covers clinical costs. However, many individuals find that Components A and B with each other still leave gaps in what is covered, so they acquire a Medicare supplement (or Medigap) strategy.

Unknown Facts About Medicare Graham

There is normally a costs for Part C policies on top of the Component B costs, although some Medicare Benefit prepares deal zero-premium strategies. Medicare West Palm Beach. Evaluation the protection details, expenses, and any kind of added advantages provided by each plan you're considering. If you enroll in initial Medicare (Parts A and B), your premiums and insurance coverage will coincide as other individuals who have Medicare

(https://www.magcloud.com/user/m3dc4regrham)This is a set amount you may need to pay as your share of the price for care. A copayment is a fixed quantity, like $30. This is the most a Medicare Advantage member will have to pay out-of-pocket for covered services every year. The quantity differs by plan, once you reach that limit, you'll pay absolutely nothing for protected Part A and Part B solutions for the remainder of the year.

Report this wiki page